XRP Treasury's Shift from Speculation to Strategy

XRP Treasury Gamble's Long-Term Stake: Will Ripple's Prolonged Investment Yield Returns?

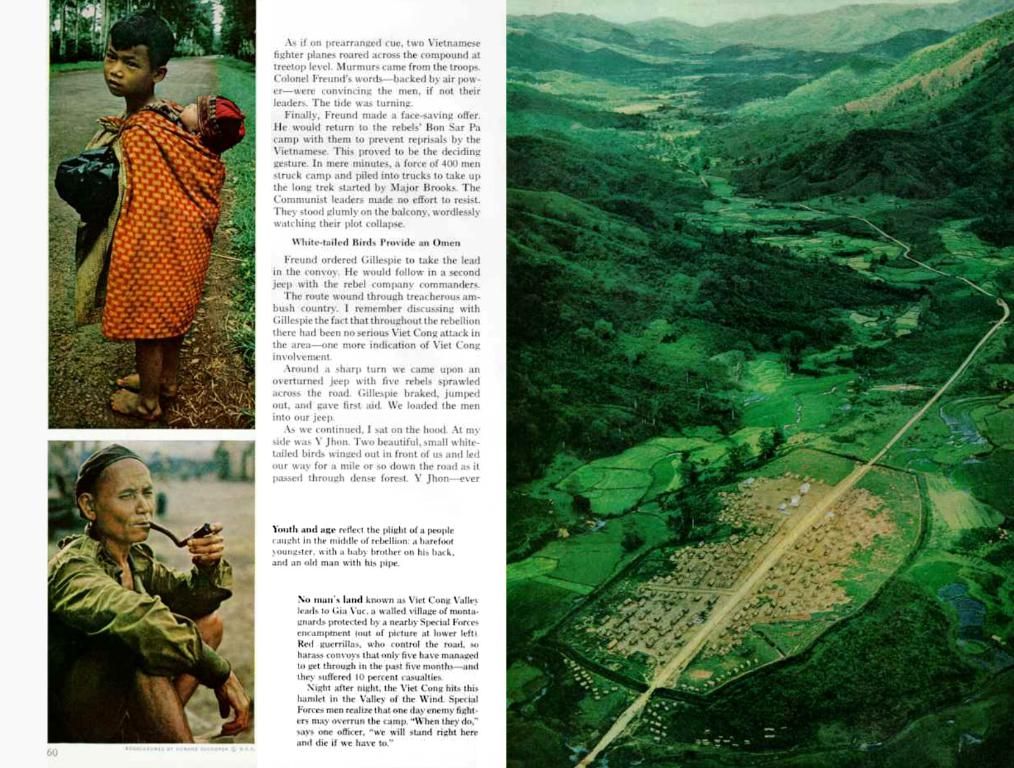

Hey there! We've got some juicy data on the XRP market that's worth checking out.

Ripple [XRP] has been stubbornly hanging onto the $2 support, keeping market-wide capitulation at bay. But don't let those single-digit losses fool you. The real action is happening under the hood, where Ripple is subtly shifting from speculative maneuvers to long-term strategic placements.

Now, you might have heard about the XRP treasury launch. But it's not just about price action. According to our analysis, XRP's current consolidation phase is laying the groundwork for a much grander, long-term play by Ripple. You see, smart money is now steering the ship, and the whiff of capitulation is quickly fading away.

Open Interest tells the tale. XRP has been coiling between $4-$5 billion for over two months, indicating a market moving away from speculative leverage towards conviction-driven utility.

While big boys like Ethereum [ETH] and Solana [SOL] have been breaking down hard, racking up double-digit losses as leveraged longs got tossed out, XRP's tighter 4.78% drawdown screams controlled, wise positioning. And that, my friend, is how you avoid liquidation cascades that can ruin a market's sentiment in a heartbeat.

Source: CoinGlass

Speaking of sentiment, the market seems to be taking notice too. Singapore-based Trident Digital (NASDAQ: TDTH) is planning to rake in $500 million to launch the world's biggest corporate XRP treasury. But this isn't just a passive accumulation to enlarge their treasure chest. These funds will be actively put to work by using XRP for staking to earn yield. In other words, they're placing a bold bet on Ripple's long-term utility and value flow.

Now, let's talk about XRPL's DeFi future, which is looking brighter by the day. Circle has finally launched native USDC on the XRP Ledger, and that's nothing short of fantastic news. This means developers and institutions can now work their magic on the XRPL platform using USDC for a variety of purposes like swift B2B payments or whipping up fresh financial apps on the block.

More importantly, native USDC is going to breathe life into the DeFi sector on XRPL. With native USDC in play, projects can start locking up value in lending protocols and liquidity pools, providing a much-needed boost to XRPL's Total Value Locked (TVL). And as the TVL grows, so does the demand for XRP to fuel those transactions, even if the price doesn't jump right away.

So there you have it, folks. Ripple is subtly shifting its focus towards long-term strategic positioning, all while the XRPL platform gets ready for decentralized finance (DeFi) action. It's a brave new world out there, and XRP looks well-positioned to ride this wave of change.

Oh, and did we mention? That $500 million XRP treasury might just be the first drop in a growing ocean. With less wild speculation, steadier price action, and real-world utility knocking on Ripple's door, we could be looking at a future teeming with XRP treasuries. Buckle up, folks! The ride is about to get interesting.

Subscribe to our must-read daily newsletter

Ethereum: Smart money swoops in as ETH plummets 9% - What's next? Stay in the loop, subscribe now!

- The XRP treasury's shift from speculation to strategy is being accompanied by a consolidation phase, indicating a move away from speculative leverage towards conviction-driven utility.

- Singapore-based Trident Digital is planning to launch the world's biggest corporate XRP treasury, with funds to be actively put to work by using XRP for staking to earn yield.

- Circle has launched native USDC on the XRP Ledger, opening up opportunities for developers and institutions to create a variety of financial applications on the XRPL platform.

- With native USDC in play, projects can start locking up value in lending protocols and liquidity pools, potentially boosting XRPL's Total Value Locked (TVL).

- Less wild speculation, steadier price action, and real-world utility are driving a future where we might see a growth in XRP treasuries, making the XRP market a potentially exciting investment opportunity in cryptocurrency, finance, and technology.