Urbanic's potential edge might lie in its deliberate avoidance of certain business practices.

BrandWagon Online Exclusive:

Urbanic's Anti-Sprawl Strategy: A Tech-Driven Approach that Keeps the Brand Efficient and Relevant

Shailja Tiwari Follow Us In a rapidly evolving Indian fast fashion market, one brand is bucking the trends, eschewing the common path of expansion and diversification. While fellow players chase after price wars, omnichannel experiments, and aggressive Gen Z targeting, Urbanic is quietly revolutionizing the game with a unique, data-driven approach. This tech-savvy brand, with no physical stores, no men's line, and no imminent plans to become a lifestyle label, is standing out in a post-Shein, post-COVID India.

Embracing Technology: The Urbanic Difference

"We're not a traditional fashion brand," Rahul Dayama, Urbanic's founding partner, told us. "Our DNA is a technology platform that powers our supply chain and helps us respond swiftly to real-time demand signals. We don't operate like a typical apparel company."

Urbanic's AI-backed supply chain allows for forecasting demand, stocking inventory based on weather patterns and consumer behavior, and minimizing unsold products. According to Dayama, psychographics matter more than demographics in Urbanic's backend operations. "For us, understanding consumer behaviors and aspirations is essential. AI and psychographic data help our backend adjust to regional and seasonal changes," he explains. This flexibility sets Urbanic apart, as what sells in Brazil during summer might not be the same as what flourishes in Delhi during the monsoons.

Instead of planning fashion seasons months in advance, Urbanic views each week as a potential micro-season, with algorithms influencing production and inventory levels. The brand also prioritizes inventory efficiency by mapping demand at the pin code level, ensuring availability across India's metros and large Tier-2 markets. By forgoing offline stores, Urbanic caters to consumers in both urban centers and smaller cities, ensuring that trending silhouettes and shades are accessible to all.

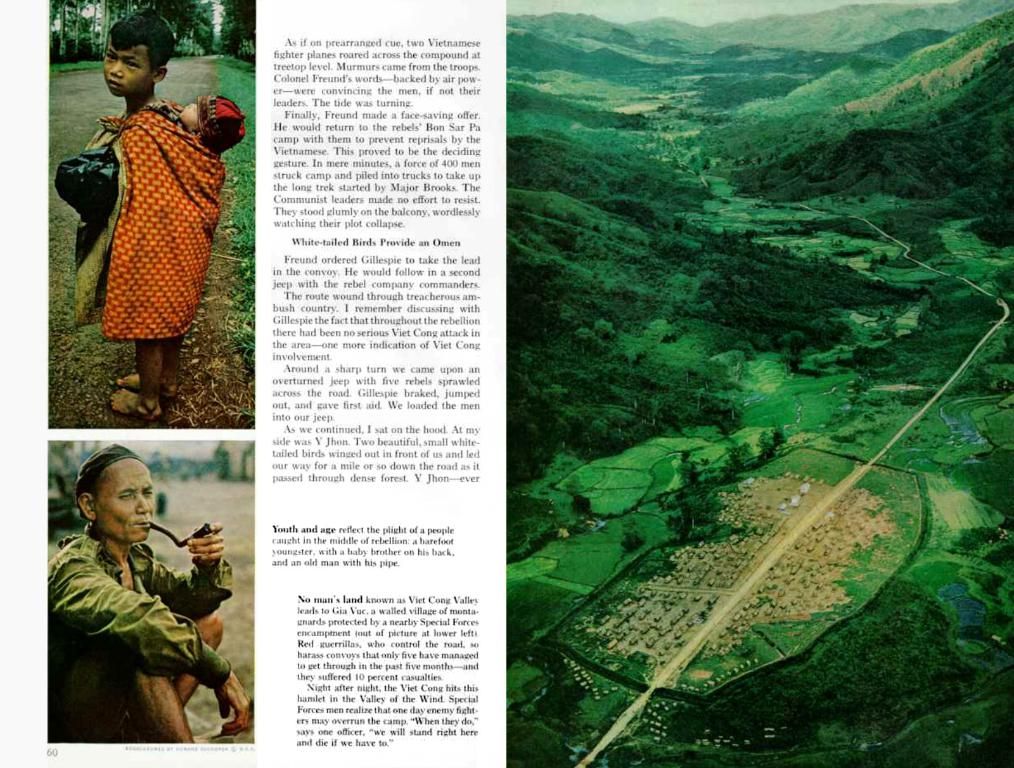

Leaning on Influencers: Building Relationships In-House

A key ingredient in Urbanic's consumer engagement strategy is a vast network of content creators. Over the years, the brand has collaborated with over 35,000 influencers nationwide, built and managed entirely in-house without agency assistance. This setup enables long-term, tailored relationships with creators and allows the brand to resonate with various consumer cohorts.

"We work with around 500 creators every month, across barter and paid campaigns. I always tell my team-the end consumer should always be our client, not the brand. That perspective transforms content creation," Dayama shares. By focusing on the consumer, Urbanic creates relevant, engaging content across Instagram, YouTube Shorts, and WhatsApp, catering to its 16-35-year-old target demographic.

Recently, Urbanic ran a campaign with creators inside the warehouse, aiming to showcase order fulfillment and build trust with consumers who value transparency and operational credibility. This agile, platform-specific content creation model helps Urbanic respond quickly to emerging trends, ranging from silhouette shifts to seasonal color palettes.

Designing for India: Price and Quality in Harmony

Urbanic's price point, primarily between Rs 999 and Rs 2,499, targets the aspirational consumer seeking trendy fashion at accessible prices. Foregoing excessive inventory is key to Ensuring affordability without compromising product quality. "We've put in research to find fabrics that can withstand Indian weather. AI helps design silhouettes based on how the Indian body responds to cuts and curves. Our denim line, for instance, is engineered using fit data to ensure both flexibility and comfort," Dayama explains.

The brand also acknowledges India-specific merchandising cycles, prioritizing summer-friendly fabrics, monsoon-suitable fits, and UV-protective layering options over following global seasonal calendars. However, Urbanic exercises caution when experimenting with new categories or extended size ranges, expanding only when internal data suggests sustained demand.

"Our approach to inclusivity is data-driven. We've grown our size range where we identified gaps in the market, but we never aim for inclusivity just for the sake of appearances. Fit, quality, and consistency are our top priorities," says Dayama.

A Focused Approach: Saying No to Diversification

While many brands are expanding into men's wear, footwear, accessories, and more, Urbanic chooses to maintain a tight focus. Its core consumer base is female, urban, and socially active, which allows for deeper engagement rather than prematurely chasing new verticals.

"There's always a temptation in this space to do too much, too fast. We've intentionally avoided that. For now, women's fashion in urban India is a big enough market, and we're still exploring its depths," Dayama says. "Instead of doing five things half-heartedly, we'd rather do one thing exceptionally well."

The Road Ahead: Navigating Sustainability and Ethical Consumption

Urbanic's current positioning lies somewhere between Shein's hyper-fast fashion model and Zara's high street appeal, but with a stronger emphasis on data and localization. While Urbanic's backend efficiency and concentrated brand architecture offer a competitive edge, the brand's growth trajectory will ultimately depend on its ability to adapt to rising sustainability, ethical sourcing, and value-oriented consumption concerns, especially as Gen Z consumers grow more vocal on these matters.

"At Urbanic, fashion isn't merely about trends; it's about precision, agility, and purpose. Our razor-sharp focus on efficiency and innovation has led to less than 1% dead stock, demonstrating a single-minded commitment to staying ahead of the curve and minimizing waste," Dayama concludes.

For Urbanic, staying relevant may not require becoming bigger, but rather staying sharper, faster, and more in tune with its audience's wants and needs.

- Urbanic's tech-driven approach in finance, utilizing AI and psychographic data, helps the brand swiftly respond to real-time consumer demand and preferences, setting it apart in the Indian fast fashion market.

- To build relationships with consumers, Urbanic leverages an extensive network of in-house content creators and focuses on offering relevant, engaging content across various social platforms, catering to its target demographic of 16-35-year-olds.

- Despite the pressure to diversify, Urbanic maintains a focused approach on women's fashion in urban India, valuing depth of connection with its core consumer base over rapidly expanding into new verticals.

- As the brand's future unfolds, Urbanic aims to navigate sustainability, ethical sourcing, and value-oriented consumption concerns, especially as Gen Z consumers prioritize these issues, while staying relevant by emphasizing precision, agility, and purpose in its fashion offerings.