Unveiling the Sad Reality of Retiring Social Security at 70

Maximizing your Social Security benefits might seem like a no-brainer, waiting until age 70 to apply. That's when you stop accruing delayed retirement credits, which increase your monthly check for each month you delay. By age 70, your monthly check could be about 77% bigger than if you'd claimed at age 62.

But the truth is, claiming Social Security at 70 isn't always the best move. Here's why:

You might end up with more by claiming earlier

Social Security benefits, you're probably thinking you should wait until age 70 to apply. After all, 70 is the age when you stop accruing delayed retirement credits, which increase your monthly check for each month you wait to claim Social Security. All things being equal, you'll end up with a check about 77% bigger than what you'd receive if you claimed as soon as possible at age 62.

The main reason for waiting until 70 is that the increased monthly benefits will eventually offset the foregone years of no Social Security payments in your 60s. However, this plan only works if you live long enough to make up for the late start. But, as many studies show, it's not always the case.

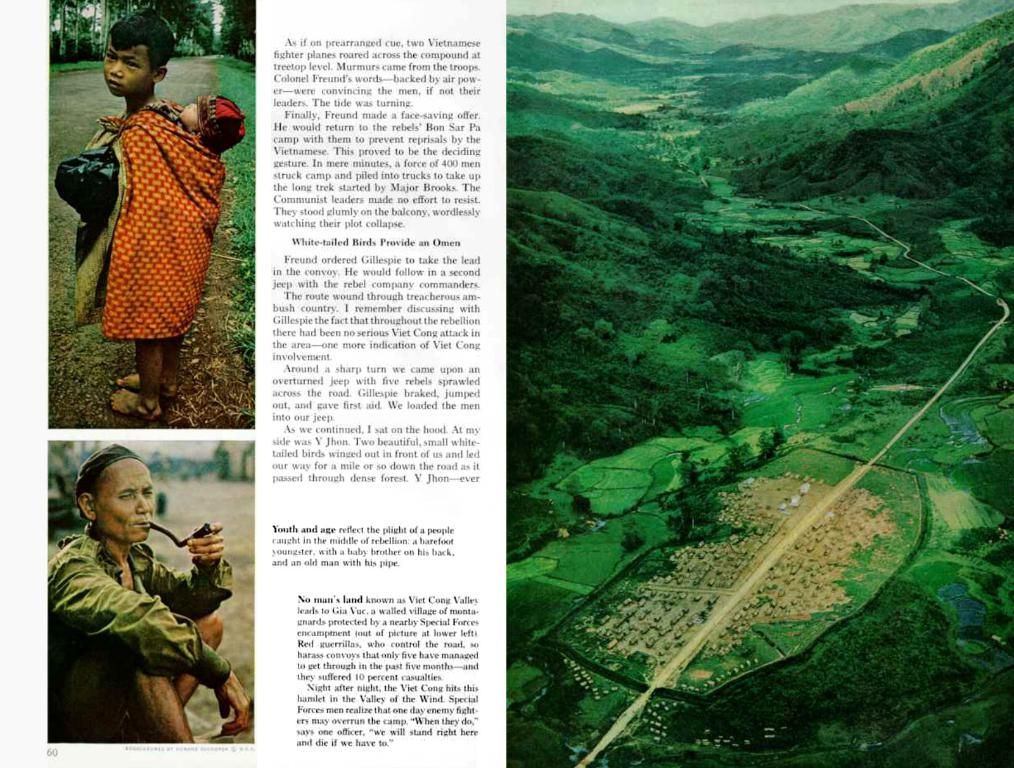

Even in studies that examine the optimal age to claim Social Security, waiting until 70 isn't always the best choice for everyone. For instance, a 2019 United Income study found that 57% of seniors would maximize their wealth in retirement by waiting until age 70. But life expectancy data from the CDC suggests that people in their 60s, on average, will live just long enough to make 70 the optimal age. That means it's only slightly better than a 50% chance that 70 is the optimal age for you, specifically.

To determine whether it makes sense to delay until 70, consider your personal health and family history. If you're in excellent health and your family has a history of living well into their late 80s and 90s, then delaying could be a good choice. On the other hand, if you have a chronic disease or a family history of early deaths, it might not be wise.

You might rely too much on your retirement savings in your 60s

withdrawal rate once you start collecting benefits at 70, it could be too late at that point to make up the difference. The result is less wealth overall.

Waiting until 70 can also put you at risk of relying too heavily on your retirement savings in your 60s. This is due to sequence of return risk. Sequence of return risk is the risk that your portfolio will see weak returns in the early years of your retirement. At that point, you might not have enough assets to make up for the losses later.

To mitigate sequence of return risk, consider temporary lowering your withdrawal rate by foregoing luxury expenses or making inflation adjustments during market downturns. You could also adjust your asset allocation to include more cash to help offset potential declines from riskier assets.

Spousal benefits can be worth as much as half the amount the primary beneficiary would receive at

Your household income could be higher

The decision to claim Social Security becomes more complex when you consider how it might impact your spouse's benefits or how your spouse's benefits might impact your Social Security.

full retirement age. In order to receive that amount, you only have to wait until your own full retirement age to claim, which is 67 for anyone born in 1960 or later.

Spousal benefits can be worth as much as half the amount the primary beneficiary would receive at full retirement age, which is 67 for anyone born in 1960 or later. However, both spouses must claim benefits for the lower-earning spouse to receive spousal benefits.

On one hand, delaying until 70 can leave your widow(er) with a bigger monthly check once you pass. On the other hand, claiming early can enable spousal benefits that may be more beneficial for your household income overall. Sit down with a professional to understand the various scenarios and choose the best option for you.

Claiming Social Security at age 70 is not always a no-brainer decision. Consider your personal health, family history, sequence of return risk, and household income before making your decision.

- Despite the increased benefits at age 70, claiming Social Security earlier might provide more overall wealth for some individuals, as suggested by a 2019 United Income study that found 57% of seniors would maximize their retirement wealth by doing so.

- By delaying Social Security until 70, you could put yourself at risk of relying too heavily on your retirement savings in your 60s due to sequence of return risk, which is the risk of experiencing weak returns in the early years of retirement.

- Spousal benefits can be significant, as they can be worth as much as half the amount the primary beneficiary would receive at full retirement age. However, both spouses must claim benefits for the lower-earning spouse to receive spousal benefits.

- To make an informed decision about when to claim Social Security, it's important to consider various factors, including personal health, family history, sequence of return risk, and how claiming at different ages could impact your household income.