Power failure in Spain and Portugal sparks conversation about digital currency as an alternative solution.

Plunging into the Dark: Spain and Portugal's Power Outage Fiasco and the Future of Digital Currencies

The recent massive blackout in Spain and Portugal, causing hassles for payment systems, communication infrastructure, and daily necessities, has reignited debates about the dependability of digital currencies, especially the European Central Bank's (ECB) digital euro project.

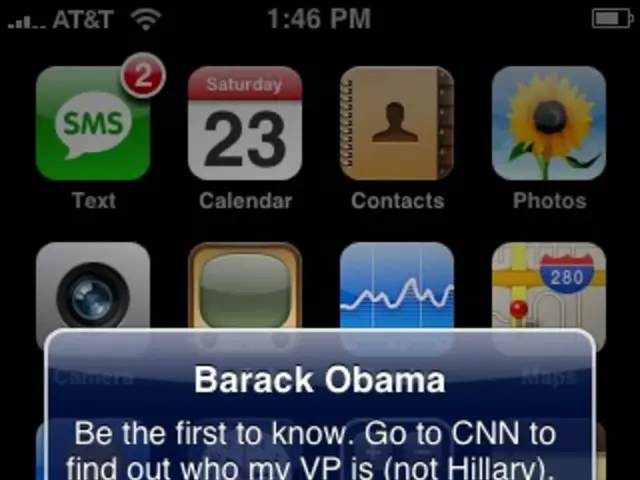

During the blackout, mobile networks and internet connections took a hard hit. People found themselves stranded without proper communication channels to reach friends and family, card readers at supermarkets ceased to function, and ATMs refused service due to the lack of electricity. The only respite was for individuals who carried cold, hard cash. Those reliant on smartphones for transactions were left high and dry.

One hapless traveler's predicament in Madrid, trapped in a pitch-black metro, climbing a 15-story staircase to evacuate, and scrambling for hours to find a taxi with nothing but 15 euros in cash before finally boarding a bus and missing their flight, epitomizes the extent of the pandemonium.

The Digital Euro Debate Amplified

The chaos that ensued made central banks reconsider the digital currency path. While the ECB asserts that the digital euro will play a role in boosting cross-border transactions, such functionalities seem infeasible when electrical power is out.

Meanwhile, the Spanish government has taken steps to curb cash usage in recent years as part of their efforts against tax evasion and money laundering. Regulations bar businesses from accepting more than 1,000 euros in cash at a time. However, according to ECB data, 57% of Spanish consumer transactions are still cash-based.

Cold, Hard Cash: Still Relevant?

The blackout also served as a grim reminder of an advisory from the Swedish central bank urging citizens to keep enough cash on hand to cover basic needs for a week.

The ECB views the digital euro as a promising means to bolster Europe's economic future. Yet, a survey found that only 45% of respondents are open to adopting the digital euro. This figure has seen modest shifts despite increased awareness.

One major reason for this reluctance could be the widespread usage and practicality of existing digital payment systems such as contactless cards and apps like Apple Pay. Additionally, concerns over privacy infringements and the potential tracking of individuals' spending habits through digital currencies are eroding confidence.

Beyond the Bitcoin Bustle

Cryptocurrencies like Bitcoin remain confined to a separate sphere. Bitcoin's volatile nature makes it less suited for daily transactions, but it appears resilient in situations like power outages, resembling gold for value storage purposes.

Even as life in Madrid gradually returns to normal, residents may shift their reliance on cold, hard cash. By extension, the ECB's digital euro project now faces a tougher landscape of public opinion.

$600 Bonus from Binance (Exclusive for our website users): Sign up using this link and earn a special $600 bonus from Binance*Details** FacebookTwitterLinkedInTelegram**

Power outages, if anything, showcase the vulnerability of digital currencies in crisis situations. While robust backup systems, decentralized networks, and offline capabilities could address these challenges, the recent events serve as stark reminders that digital currencies, in their present form, may not be synonymous with resilience and reliability in extreme situations.

- The breakdown in Spain and Portugal's power grid highlighted the potential issues with leveraging digital currencies, including the ECB's digital euro project, during crises.

- As a result of the outage, many people found themselves heavily reliant on traditional cash as other methods of payment, such as smartphones and ATMs, became inaccessible.

- The ECB believes the digital euro has the potential to strengthen Europe's financial future; however, a survey revealed that only 45% of respondents are willing to embrace the concept, raising questions about its viability in the general populace.

- In light of the blackout, the advisory from the Swedish central bank urging citizens to keep enough cash on hand to cover basic needs for a week has gained renewed relevance as people reassess their reliance on digital technology during emergencies.