Booming Digital Receipts Industry Shows Strong Expansion at a Rate of 11.5%

## Key Business Opportunities in the Digital Receipts Market

The digital receipts (e-receipts) market is experiencing rapid growth, with a projected global value of $293 billion by 2030[1]. This expansion is driven by the surge in online shopping, food delivery services, and the convenience of online payments, trends that show no signs of slowing down. Within this landscape, mobile payments and cloud storage are emerging as particularly fertile ground for new business opportunities.

### Mobile Payments Sector

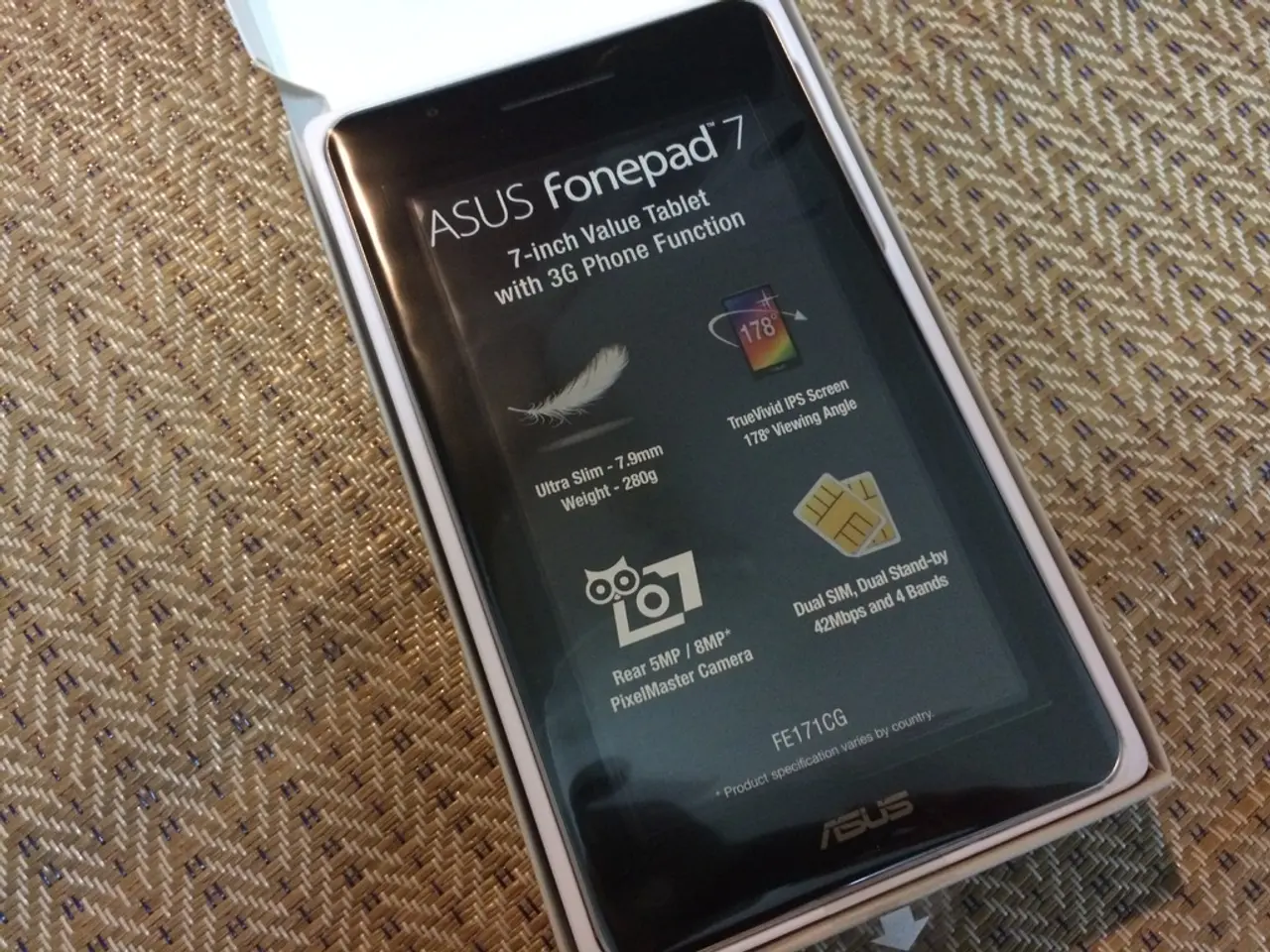

The proliferation of mobile POS (mPOS) systems, which turn smartphones into payment terminals, is a major growth area. The global transaction value for mobile POS is expected to reach $24.56 trillion by 2027, with the UK leading European adoption due to strong contactless infrastructure and regulatory support[2]. This presents opportunities for providers who can integrate digital receipt delivery directly into mobile payment flows.

Cost savings for small and medium-sized enterprises (SMEs) are another driver for the mobile payments sector. Mobile POS solutions offer lower total cost of ownership and rapid deployment, making them especially attractive for these businesses[2]. Companies that can bundle digital receipt solutions with affordable, easy-to-deploy mobile payment systems will find a receptive audience among these businesses.

As mobile payments become ubiquitous, there is growing demand for seamless, instant digital receipt delivery via SMS, email, or app notifications. Providers that offer customizable, interactive e-receipts—featuring personalized offers, loyalty program integration, or easy expense tracking—can differentiate themselves in a crowded market[1].

The rise of SoftPOS (software-based POS that turns any NFC-enabled device into a payment terminal) is expected to grow from $246.6 million in 2022 to over $1 billion by 2030[2]. This creates opportunities for startups and established players to offer integrated digital receipt solutions that work across a wide range of devices and payment scenarios.

### Cloud Storage and Data Analytics

Cloud-native POS platforms are reshaping merchant payments by blending AI, IoT, and omnichannel tools to boost efficiency and customer experience[2]. These platforms naturally generate vast amounts of transactional data, which can be stored, analysed, and leveraged for personalised marketing, inventory management, and customer insights. Providers that offer secure, scalable cloud storage for digital receipts—coupled with advanced analytics—can help retailers turn receipt data into actionable business intelligence.

As businesses and consumers grow more eco-conscious, digital receipts offer a clear sustainability advantage over traditional paper receipts[3]. Cloud-based receipt storage not only reduces paper waste but also ensures compliance with data retention regulations. Companies that emphasize green credentials and regulatory compliance in their cloud storage offerings will appeal to forward-thinking retailers.

There is a growing need for digital receipt solutions that integrate seamlessly with cloud-based accounting, ERP, and CRM systems. Providers that enable automatic synchronization of receipt data across these platforms can reduce administrative overhead for businesses and improve accuracy in financial reporting.

### Additional Cross-Sector Opportunities

Digital receipts can be customized with personalized messages, recommendations, and special offers based on purchase history, helping businesses build stronger customer relationships and drive repeat sales[1].

Mobile apps that aggregate and categorize digital receipts from multiple sources can simplify expense tracking for both individuals and businesses, creating opportunities for fintech innovators.

As digital receipts contain sensitive transaction data, providers that offer robust encryption, secure cloud storage, and fraud detection features will be well positioned to address growing concerns about data security.

## Summary Table: Key Opportunity Areas

| Sector | Opportunity Description | Drivers | |---------------------|----------------------------------------------------------------------------------------|------------------------------------------| | Mobile Payments | Integrated e-receipts in mPOS/SoftPOS, personalized offers, expense tracking apps | Contactless adoption, SME demand, cost savings[2] | | Cloud Storage | Secure receipt storage, analytics, integration with accounting/ERP, sustainability focus | Data growth, regulatory needs, green trends[3] | | Cross-Sector | Personalization, loyalty integration, security solutions | CX focus, fraud concerns, compliance[1] |

## Conclusion

The digital receipts market offers substantial opportunities in mobile payments (through mPOS, SoftPOS, and personalized engagement) and cloud storage (via analytics, integration, and sustainability). Success will favour providers who can deliver seamless, secure, and value-added solutions that address both operational efficiency and evolving customer expectations[1][2][3].

The transition to digital receipts can increase investment in new technologies and software solutions, which are being absorbed by companies that need to upgrade their payment systems, POS devices, and cloud-based services. Key players in the digital receipts market are focusing on developing integrated solutions that connect payment systems with digital receipt platforms.

In 2023, North America accounted for over 36% of the market share, with revenues reaching USD 0.7 billion. The growth of the digital receipts market is driven by the increasing shift towards digital solutions, fueled by consumer demand for convenience and sustainability. The Middle East and Latin America are emerging as important markets for digital receipts as digital adoption increases.

The growth of the digital receipts market is influencing the global economy by fostering innovation in cloud computing, mobile payment solutions, and data analytics. Asia-Pacific is expected to see the fastest growth in the digital receipts market, driven by expanding mobile payment infrastructure and increasing digitalization in countries like China, India, and Japan.

Businesses are adopting digital receipts for better customer engagement, cost reduction, and environmental impact. The retail segment leads the digital receipts market in terms of application. The digital receipts market is segmented by technology, application, and region. The technology segment includes cloud-based systems, mobile applications, and POS-integrated solutions, with cloud-based systems expected to dominate due to their scalability and flexibility.

The growing preference for paperless transactions and the rise in mobile payment platforms are key drivers of this market expansion. The Global Digital Receipts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5%, reaching USD 5.1 billion by 2033. As digital receipts gain traction, they are likely to disrupt traditional retail and customer service models, creating new business opportunities, especially for fintech, cloud service providers, and software developers.

Companies can capitalize on the growing demand for digital receipts by offering integrated solutions for mobile and in-store transactions. In sectors like retail and hospitality, businesses are now focusing on digital adoption, which could require restructuring supply chains to handle new software and hardware requirements. With increasing concerns over environmental sustainability, businesses are focusing on promoting the eco-friendly benefits of digital receipts.

Businesses can capitalize on the integration of personalized digital receipts with affordable, easy-to-deploy mobile payment systems, as this solution is attractive to small and medium-sized enterprises (SMEs) seeking cost savings. Furthermore, providers who offer secure cloud storage for digital receipts, coupled with advanced analytics, can help retailers turn receipt data into actionable business intelligence, capitalizing on the demand for digital solutions due to growing concerns over environmental sustainability and data retention regulations.